GDR Model Update - Monday 24 Oct 2022

Friday's rally was most likely short-covering - what's coming up next?

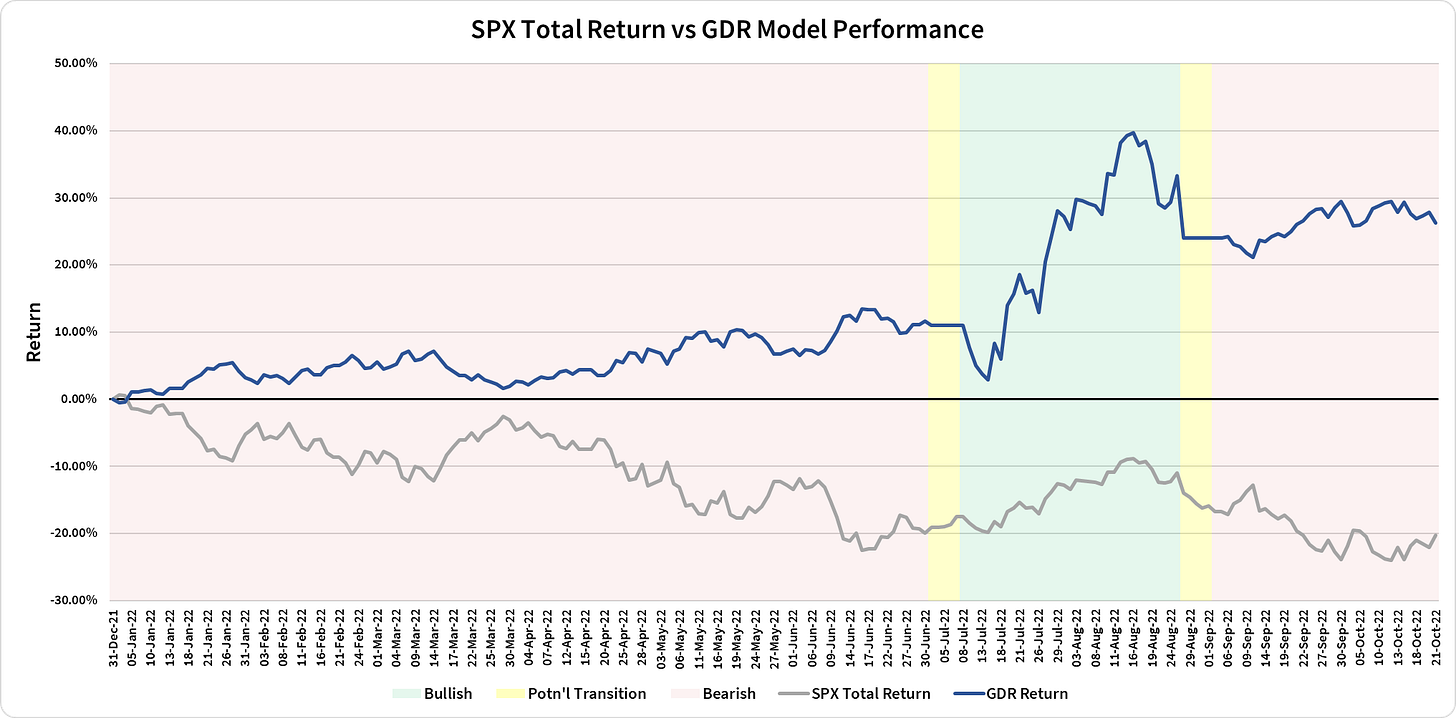

2022 Performance as of the close of 21 Oct 2022

GDR Model: +26.33%

S&P 500 Total Return: -20.25%

Sharpe Ratio: 3.10

Commentary: the S&P 500 returned +4.75% over the last week. Given that the model entered the week bearish, it gave some its positive performance back.

GDR Model Update for the week of 24 Oct 2022

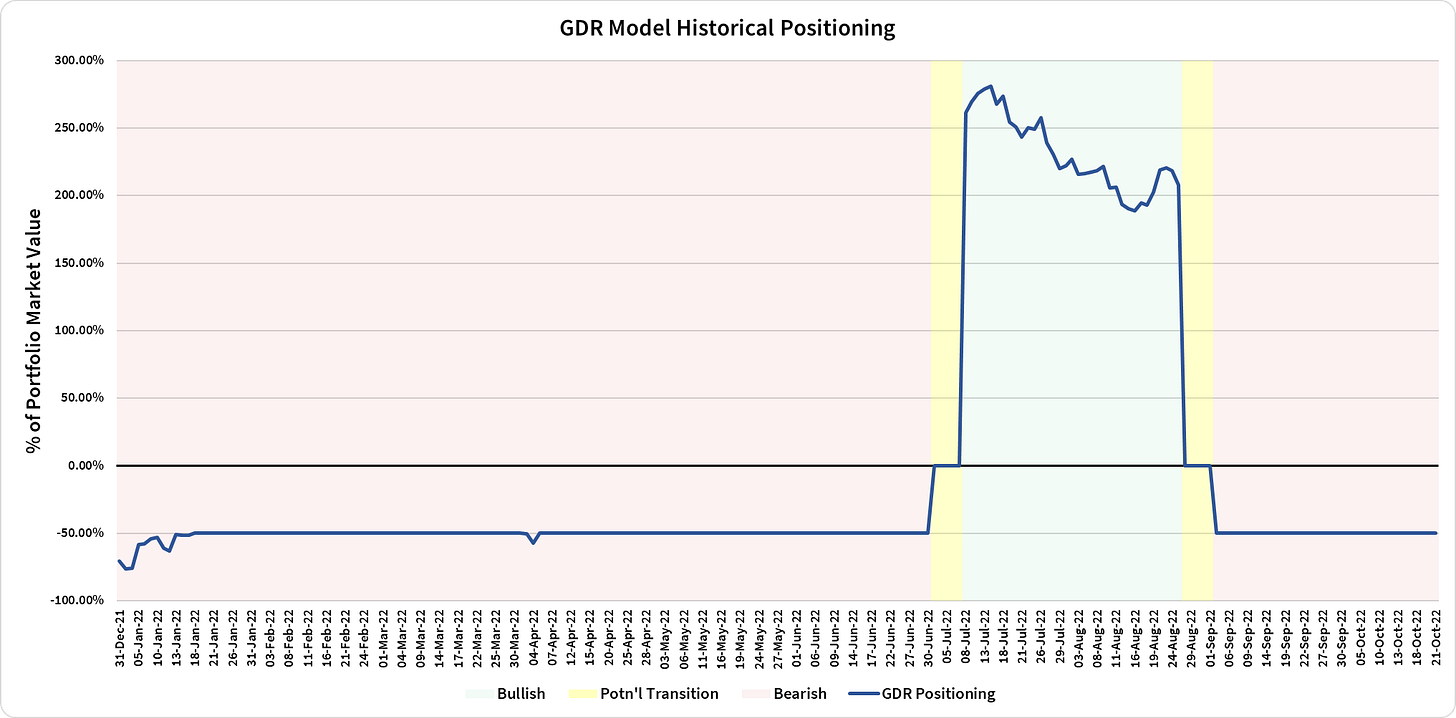

Market Tone: Bearish

Positioning: -50.00%

Commentary: despite the strong rise in the S&P 500, the GDR Model remains firmly bearish as it is more focused on catching longer-lasting moves in the index. Moreover, the strong move last Friday appears to be more in line with short-covering precipitated by monthly options expiration.

GDR Model Historical Charts

Short-Term ES Market Structure Update

The coming week has strong potential for volatility with a number of S&P 500 companies reporting earnings, including MSFT 0.00%↑, GOOGL 0.00%↑, V 0.00%↑, META 0.00%↑, AAPL 0.00%↑, AMZN 0.00%↑, XOM 0.00%↑, and CVX 0.00%↑. In addition, PCE data will come out for September on Friday - this is the Fed’s preferred inflation metric.

While last Friday’s low seems secure, the day ended with a low conviction spike up. The key to watch for tomorrow is whether Friday’s afternoon spike is rejected (market trades below 3741) or accepted (stays above 3741, preferably with continuation). In addition, bear in mind that this is also the latest of many attempts to break out of what is now an 18-day balance/consolidation zone.

Potential Market-Moving Events

09:45am - Manufacturing PMI, S&P Global Composite PMI, Services PMI

11:00am - Treasury Secretary Yellen Speaks