S&P 500 Daily Perspective for Mon 13 Jan 2025

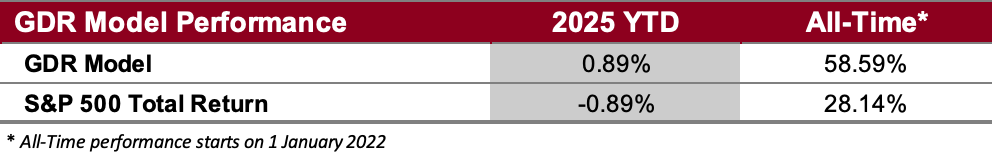

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated and a chart.

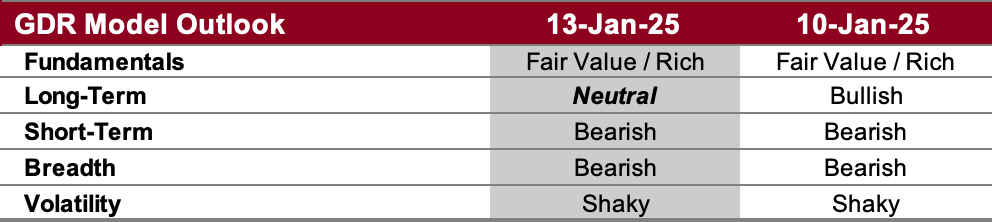

GDR Model Outlook

The GDR Model is mostly bearish. The recent indecision in the market seems to be dissipating and it looks to be strongly leaning bearish at this point.

Fundamentals Outlook (as of 17 Jun 2024): for the first time in a while the model is showing stocks as being richly valued (i.e. overpriced). Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

Long-Term Outlook (as of 10 Jan 2025): after recovering a bit last week, the market closed weak again this week. The Long-Term Outlook has been downgraded to neutral and If this weakness is sustained, the odds of a significant sell-off will increase significantly.

Short-Term Outlook (as of 10 Jan 2025): the market showed weakness in the short-term consistently throughout this week. The inflation data coming out next week (Tuesday, Wednesday) will be moments to pay attention to; if the market is truly weak, those releases are likely to be followed by strong liquidations.

Breadth Outlook (as of 10 Jan 2025): breadth continues to be bearish, which is additional evidence of weakness in the market.

Volatility Outlook (as of 10 Jan 2025): the Volatility Outlook came within a hair’s breadth of a downgrade on Friday. A volatile outlook implies that the market can experience significant drops (as well as short-covering rallies) in short timespans.

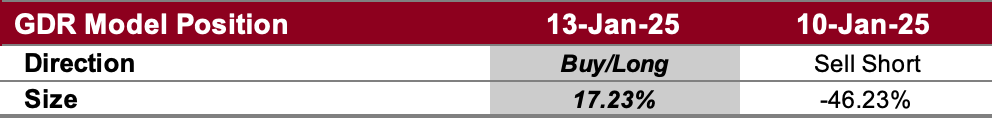

GDR Model Position

The GDR Model closed its short position and opened a very modest long. Given the current context, this does not at all suggest that the model expects the market to strengthen next week. Rather it just means that the odds of a sustained sell-off at the start of next week are relatively low. If the model expected strength in the market then it would go long at a much bigger size.