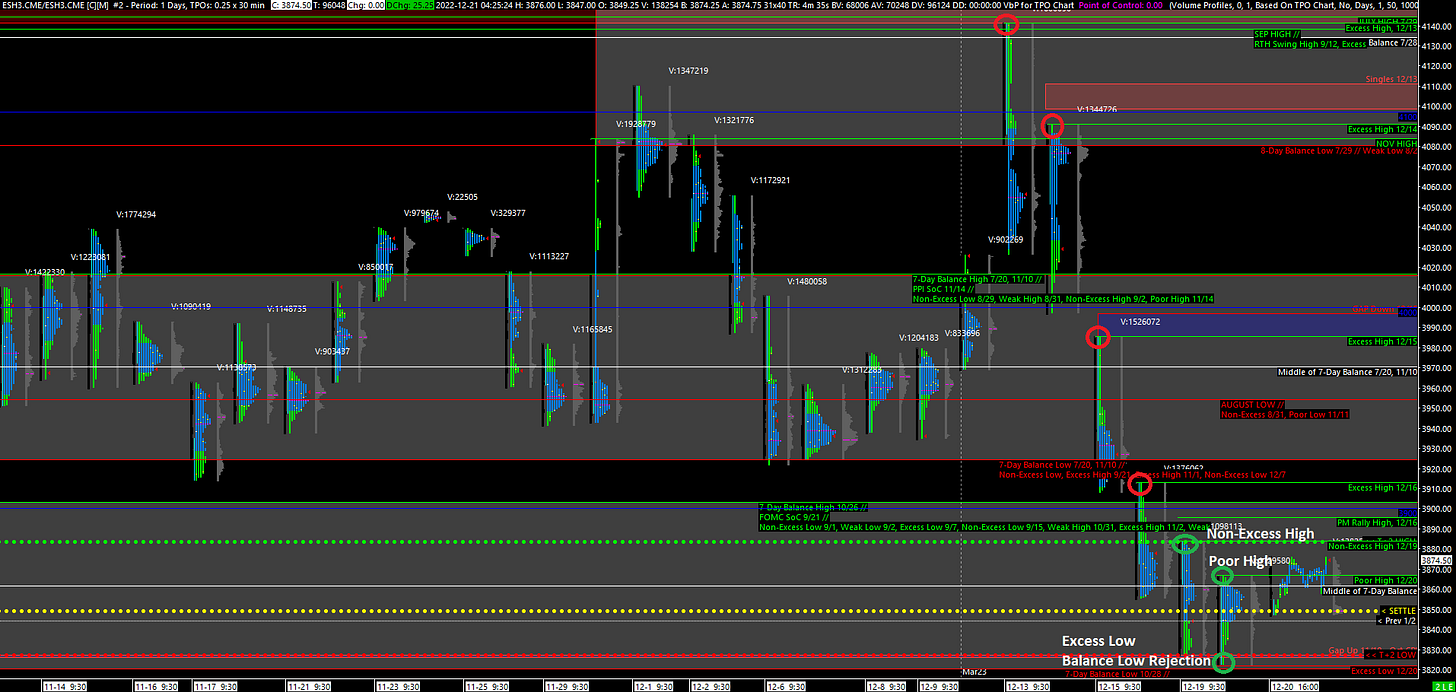

S&P 500 Futures Daily Insights for Wed 21 Dec 2022

Market Profile suggests some upside in the near-term, likely due to short-covering

GDR Model Insights for the Current Week

GDR Model Performance (2022): +13.73%

S&P 500 Total Return (2022): -18.53%

Market Tone: Potential Transition to Bearish (previous week: Bullish)

Positioning: 0.00% Flat (previous day: 0.00% Flat)

S&P 500 Futures Market Profile Insights for Tomorrow

Yesterday’s trading signals a near-term shift in the market where the ES may stabilize or even have a short-covering rally. Here is a quick breakdown of the markers:

There is an Excess Low put in soon after yesterday’s open

That Excess Low is also a rejection of a breakdown below the current Balance Zone

Monday’s Poor Low was repaired

The market is now holding above the T+2 (Settlement) Low, which reduces the odds of further liquidation

The ES closed with a Poor High in need of repair

Going back to Monday, structure that day suggests Emotional Selling, which implies additional Poor Structure in need of repair

If you decide to make long trades today, be cautious and don’t overstay your welcome. The market is still in a clear downtrend and it’s difficult to tell ahead of time how much short-covering is enough.

Potential Market-Moving Events Tomorrow

10:00am - CB Consumer Confidence, Existing Home Sales